Cease and Desist Letter Debt Collection

Cease and desist letters are versatile tools that allow you to stop others from infringing on your intellectual property or to get them to stop harassing you. In the case of stopping debt collectors, that usually falls under the latter category because of the tactics that debt collectors like to use to browbeat their targets into paying.

Let’s take a look at exactly what goes into a debt collection cease and desist letter as well as exactly how one of these letters can help you stop debt collectors from harassing you.

While a cease and desist letter won’t make your debt go away, it can give you some peace of mind.

What is a Debt Collection Cease and Desist Letter?

Believe it or not, there are guidelines to how a debt collector can approach you for the money that you owe. This is known as the Fair Debt Collection Practices Act, AKA the FDCPA. It’s a good idea to read through the FDCPA to see if your debt collectors are infringing on any of the regulations.

If you find that your debt collectors are in violation of the FDCPA, then you’re well within your rights to send that debt collector a cease and desist letter. This letter will let them know that they must stop approaching you in such a way or face the legal consequences of not following the rules outlined for them.

In some cases, this can mean an injunction against the debt collectors to stop them from legally being able to contact you in such a way. However, if the court deems that the debt collectors have caused you stress and emotionally harmed you, you may also be able to sue for damages.

Keep in mind that the matter will only be taken to court if the debt collectors do not cease and desist their actions by the time you have outlined in the cease and desist letter. Be sure to send your cease and desist letter through registered mail so that you have a receipt showing the date that you sent it out in case you need to prove it in court.

Another thing to remember is that you can send out a cease and desist letter to debt collectors if you’ve been misidentified as the holder of a debt. If this is the case, you’re contesting the debt and not the practices that are being used to collect the debt, as in other cases.

One thing to remember is that you should never admit that the debt is valid when you’re formulating your cease and desist letter if you’re contesting the debt. However, not all cease and desist letters contest the debt unless you think that it’s a case of mistaken identity.

You can either draw up these letters yourself or you can get a lawyer to formulate them, though the latter option will be a little more expensive because you’re paying for the lawyer’s expertise.

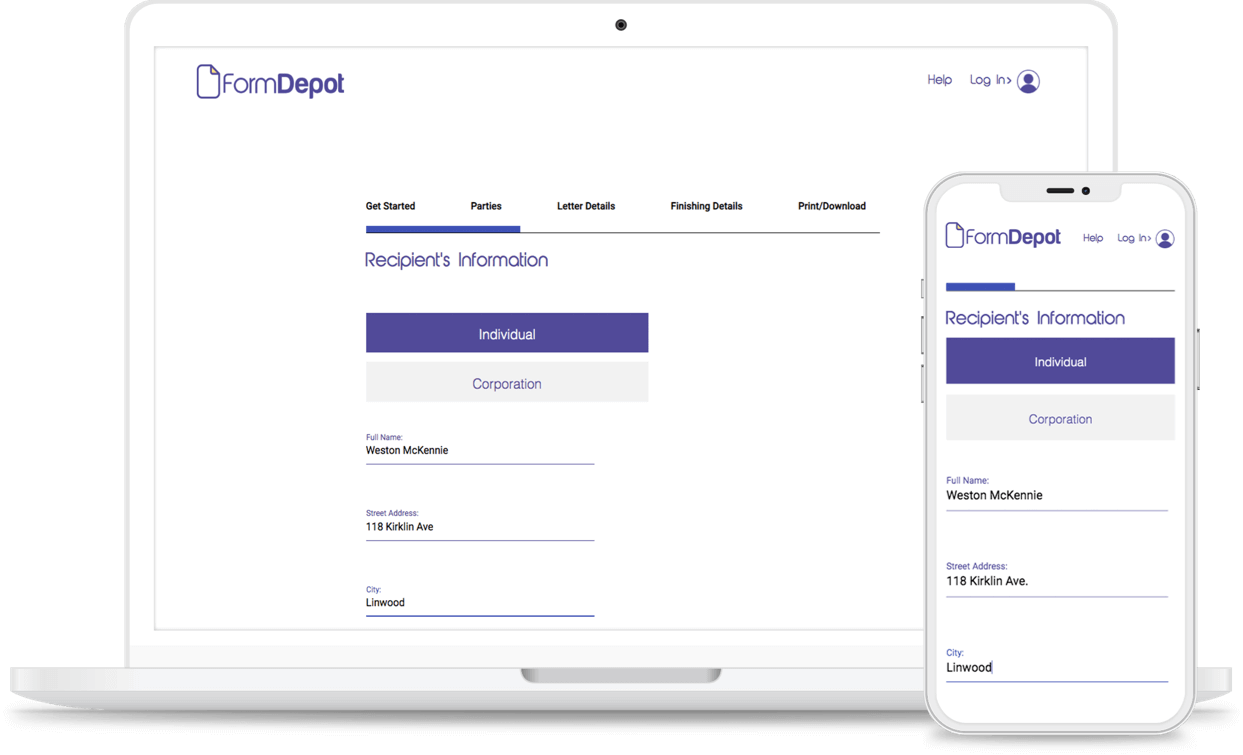

Want your document now?

Instantly create a document

Done and dusted in 5 minutes!

- Hassle Free. No Lawyels needed.

- We've helped over 1 million people create reliable legal documents.

- Fast, zero mistakes, no massive legal bills.